Sorry for not posting these past few days as I was suppose to do.

My mind got a bit clouded with stuff that includes the Stock Market.

For now, let's get back to Personal Finance shall we?

When I was still dependent from my parents, getting a loan from them was easy. They love me and they would forget about it. However, as a grown adult, that won't be the same since my parents have their own needs and they might be the ones who would need my assistance in the future.

In the corporate world, there may be times that we may need to borrow money to take care of our personal needs. These may include (but not limited to) the following.

a. Leverage for an Investment

b. Medical Expenses

c. Educational Expenses

d. Housing Repair/Improvement

I'm sure you have more that what is listed above but that's for now.

Anyway, My own criteria to consider before getting a personal loan would be the following.

1. Do you really need it Right Now?

Say you need this amount for you to cover your kid's education for the coming school year and that would be six months from now. When you try to loan that amount, what would you do for the next six months aside from paying the loan (plus interest)?

For me, I'd rather delay it and work my budget for the next six months to be able to come-up with the money needed. In case if it isn't enough, that's the time I'd get a loan, but a lower amount compared to what would be the initial loan amount.

2. Can I pay it within the shortest time possible?

Give that you were granted a loan amount you needed, can you pay it within the shortest amount of time possible? Say you need to pay it within a year, but there are unavoidable instances that you need to use that money that should have been for loan payment for something else. Would you extend your loan payment to make-up for the loss? Would you borrow money just to pay for that payment (which leads to additional debt)?

That's my take. Do you have any other ideas? Feel free to share yours in the comment section.

One man's journey to Financial Freedom despite at midlife. I'll do my best to share with you some Swabeng Money Moves towards Financial Freedom. Do you like that?

Monday, June 5, 2017

Tuesday, May 16, 2017

28. Swabeng Discussion: Lots and Lots (Board and Odd)

Whenever you trade a stock, have you noticed the amount of shares needed for you to buy or sell a stock? While you may buy a stock on a per share basis, there is a standardized way of trading them.

For starters, a board lot is defined as a standardized number of shares for a specific price range. This facilitates easier trading.

Let us refer to the table below.

Lets say you're interested to invest in Jollibee (Stock Code: JFC) on May 10, 2017 and you want to buy 100 shares. You need to check the price range for the stock. Upon checking you noticed that it costs 211.00 pesos (at the close). From there, when you checked on the table it is within the 200 to 499.8 peso range which means that the minimum number of shares for JFC would be 10 shares or equivalent to 1 board lot. Since you will be buying 100 shares of JFC, this means that you'll be buying 10 board lots of JFC.

Now, lets say someone gave you 4 shares of PLDT (Stock Code: TEL) and you wanted to sell them since you have already profited from it. Upon checking on the board, the number of your shares is not listed, hence you have to sell them via Odd Lot hoping that there are buyers out there who can match the number of shares and the price that you intend to sell the stock. Anyway, these are very seldom cases when you got to hold a stock that is an Odd Lot.

Till the next topic.

For starters, a board lot is defined as a standardized number of shares for a specific price range. This facilitates easier trading.

Let us refer to the table below.

Lets say you're interested to invest in Jollibee (Stock Code: JFC) on May 10, 2017 and you want to buy 100 shares. You need to check the price range for the stock. Upon checking you noticed that it costs 211.00 pesos (at the close). From there, when you checked on the table it is within the 200 to 499.8 peso range which means that the minimum number of shares for JFC would be 10 shares or equivalent to 1 board lot. Since you will be buying 100 shares of JFC, this means that you'll be buying 10 board lots of JFC.

Now, lets say someone gave you 4 shares of PLDT (Stock Code: TEL) and you wanted to sell them since you have already profited from it. Upon checking on the board, the number of your shares is not listed, hence you have to sell them via Odd Lot hoping that there are buyers out there who can match the number of shares and the price that you intend to sell the stock. Anyway, these are very seldom cases when you got to hold a stock that is an Odd Lot.

Till the next topic.

Thursday, May 11, 2017

27. Swabeng Discussion: The Two Types of Stock Market Players in General

Now lets move on to this topic.

I've seen several types of players in the Stock Market based on reading. But for the mean time, I'll classify them in general.

1. Traders: These are stock market players that mostly rely Technical Analysis on charts, indicators and price action for their buy and sell signals. These type usually disregard any news as they focus more on the technical aspect of the stock and its movement. These are typically active people and who are mostly alert. They can hold a position (of a stock) from as short as a few seconds to as long as a year (or sometimes two).

2. Investors: These are stock market players that mostly focuses on the fundamentals of the company. They usually invest for the long term (mostly more than 2 years) up to the time that either they're old already to pass on the shares to their heirs or a couple of years when the company has solid earnings already. They use fundamental analysis to determine the soundness (how strong the company) of the stock. These people are not affected with the noise (hype and bash) and the price movements (charts) regarding their position of the stock and always look at the bigger picture (Company's Growth). Not that they are the passive type but rather they're in for the long haul.

3. Hybrid: These are the type of Stock Market players that has a combination of skills of a trader and an investor. While hybrids read reports, financial statements and news for fundamentals, they also rely on technical skills to determine the best time to enter and exit the trade. Hybrids can hold a position from a few seconds up to a few years depending on how their stock goes. This is where each one of us here should strive for.

Anyway, which of the three types would you go for?

I've seen several types of players in the Stock Market based on reading. But for the mean time, I'll classify them in general.

1. Traders: These are stock market players that mostly rely Technical Analysis on charts, indicators and price action for their buy and sell signals. These type usually disregard any news as they focus more on the technical aspect of the stock and its movement. These are typically active people and who are mostly alert. They can hold a position (of a stock) from as short as a few seconds to as long as a year (or sometimes two).

2. Investors: These are stock market players that mostly focuses on the fundamentals of the company. They usually invest for the long term (mostly more than 2 years) up to the time that either they're old already to pass on the shares to their heirs or a couple of years when the company has solid earnings already. They use fundamental analysis to determine the soundness (how strong the company) of the stock. These people are not affected with the noise (hype and bash) and the price movements (charts) regarding their position of the stock and always look at the bigger picture (Company's Growth). Not that they are the passive type but rather they're in for the long haul.

3. Hybrid: These are the type of Stock Market players that has a combination of skills of a trader and an investor. While hybrids read reports, financial statements and news for fundamentals, they also rely on technical skills to determine the best time to enter and exit the trade. Hybrids can hold a position from a few seconds up to a few years depending on how their stock goes. This is where each one of us here should strive for.

Anyway, which of the three types would you go for?

Saturday, May 6, 2017

26. Swabeng Discussion: Earning through The Stock Market by Dividends

That Price Appreciation for the previous post was quite exciting right? Anyway, here is the other way to earn in the Stock Market

2. Dividends

As a part owner of the company, aside from the gains that you have earned (or losses incurred), you will be rewarded with dividends. These dividends can be in a form of cash (called cash dividends) or extra stocks (stock dividend).

1. Lets say at April of 2012, you bought 10,000 shares of Jollibee (Code: JFC) and you didn't add more share up to the present day. Aside from the price appreciation that you've gained, you will earn cash dividend per stock (refer to the table below)

Starting from the bottom part, a 0.58/share, cash dividend for that period would yield 5800 (excluding 10% witholding tax). The for the 0.65/share, cash dividend for that period would yield 6500 (excluding 10% witholding tax) and so on. When you add up all of the cash dividends on the table, it would give you 64,890 pesos (net of taxes). Not bad right?

Can you imagine if you bought more than 10,000 shares (lets say between 50,000 to 100,000 shares), I'm sure you'd be very delighted with your earnings through cash dividends.

That's for Cash Dividends.

Stock Dividends would be a different matter since you'll be rewarded with an additional number shares as the company has earned for a certain period (quarter or semi-annual or annual). I'll try to look for a better explanation for Stock Dividends.

That's all for now.

2. Dividends

As a part owner of the company, aside from the gains that you have earned (or losses incurred), you will be rewarded with dividends. These dividends can be in a form of cash (called cash dividends) or extra stocks (stock dividend).

1. Lets say at April of 2012, you bought 10,000 shares of Jollibee (Code: JFC) and you didn't add more share up to the present day. Aside from the price appreciation that you've gained, you will earn cash dividend per stock (refer to the table below)

Jollibee Dividends

Starting from the bottom part, a 0.58/share, cash dividend for that period would yield 5800 (excluding 10% witholding tax). The for the 0.65/share, cash dividend for that period would yield 6500 (excluding 10% witholding tax) and so on. When you add up all of the cash dividends on the table, it would give you 64,890 pesos (net of taxes). Not bad right?

Can you imagine if you bought more than 10,000 shares (lets say between 50,000 to 100,000 shares), I'm sure you'd be very delighted with your earnings through cash dividends.

That's for Cash Dividends.

Stock Dividends would be a different matter since you'll be rewarded with an additional number shares as the company has earned for a certain period (quarter or semi-annual or annual). I'll try to look for a better explanation for Stock Dividends.

That's all for now.

Monday, May 1, 2017

25. Swabeng Discussion: Earning through The Stock Market by Price Appreciation

My apologies for just showing a few on the last post. :D

Anyway, Here are the two ways how to earn in the Stock Market. This will be the first part.

1. Price Appreciation.

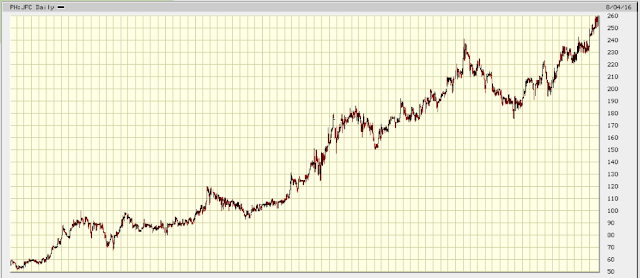

A. Let's say on January 4, 2010, you bought 1000 shares of Jollibee (Code: JFC) priced at 59.00 pesos per share (closing price) which means you have spent around 59,000 pesos (exclusive of fees and charges).

Then on August 4, 2016, you decide to sell all of your 1000 shares of Jollibee for 260.00 pesos per share (closing price). This means your 59,000 pesos has grown to 260,000 (exclusive of fees and charges) or your money has grown to around 340% since the time you bought shares of JFC. You may refer to the chart below for the price movement of JFC from the time the shares have been bought to the time the shares have been sold.

B. On the other hand, on September 4, 2014, you bought 100 shares of PLDT (Code: TEL) priced at 3460 pesos per share (closing price) which means you have spent around 346,000 pesos (exclusive of fees and charges).

Then on December 5, 2016, there was an emergency that you needed a certain amount of money but your only source was the stocks of TEL that you have. You have no other choice but to sell all 100 shares of TEL for 1280 pesos per share (exclusive of fees and charges). From the time you bought TEL until you sold them, your loss was at 63%, some that all of us don't want to happen (sell at a loss). You may refer to the chart below for the price movement of TEL from the time the shares have been bought to the time the shares have been sold.

Then how did the price per share of JFC went up from 55 pesos to 260 pesos? and How did the price per share of TEL went down from 3460 pesos to 1280 pesos?

Here's the explanation.

Price of a Stock is usually dictated by the buyers and the sellers. In a wet market it is usually called the law of supply and demand. If there is a high demand for a stock, its price would usually go up. On the other hand, if the demand for the stock is low, its price would usually go down.

Other factors for the increase and decrease of the stock's price includes updates (positive/negative) from the business, market sentiment, annual (or quarter) earnings report, as well as local and global issues that may have something to do where the certain stock is categorized.

On the next post, we will show you the other way on how to earn money in the Stock Market. Stay tuned.

Anyway, Here are the two ways how to earn in the Stock Market. This will be the first part.

1. Price Appreciation.

A. Let's say on January 4, 2010, you bought 1000 shares of Jollibee (Code: JFC) priced at 59.00 pesos per share (closing price) which means you have spent around 59,000 pesos (exclusive of fees and charges).

Then on August 4, 2016, you decide to sell all of your 1000 shares of Jollibee for 260.00 pesos per share (closing price). This means your 59,000 pesos has grown to 260,000 (exclusive of fees and charges) or your money has grown to around 340% since the time you bought shares of JFC. You may refer to the chart below for the price movement of JFC from the time the shares have been bought to the time the shares have been sold.

Jollibee's Uptrend

B. On the other hand, on September 4, 2014, you bought 100 shares of PLDT (Code: TEL) priced at 3460 pesos per share (closing price) which means you have spent around 346,000 pesos (exclusive of fees and charges).

Then on December 5, 2016, there was an emergency that you needed a certain amount of money but your only source was the stocks of TEL that you have. You have no other choice but to sell all 100 shares of TEL for 1280 pesos per share (exclusive of fees and charges). From the time you bought TEL until you sold them, your loss was at 63%, some that all of us don't want to happen (sell at a loss). You may refer to the chart below for the price movement of TEL from the time the shares have been bought to the time the shares have been sold.

PLDT's Downtrend

Then how did the price per share of JFC went up from 55 pesos to 260 pesos? and How did the price per share of TEL went down from 3460 pesos to 1280 pesos?

Here's the explanation.

Price of a Stock is usually dictated by the buyers and the sellers. In a wet market it is usually called the law of supply and demand. If there is a high demand for a stock, its price would usually go up. On the other hand, if the demand for the stock is low, its price would usually go down.

Other factors for the increase and decrease of the stock's price includes updates (positive/negative) from the business, market sentiment, annual (or quarter) earnings report, as well as local and global issues that may have something to do where the certain stock is categorized.

On the next post, we will show you the other way on how to earn money in the Stock Market. Stay tuned.

Wednesday, April 26, 2017

24. Swabeng Discussion: Stock Market (The Bare Basics)

Now that we have already discussed Mutual Funds and Unit Investment rust Funds, I guess its time to discuss some more ways to earn money passively.

That is through the Stock Market.

Now what is the Stock Market Exactly?

The Stock Market is referred to as a place where shares of Public Listed Companies are Traded (Buy or/and Sell).

To make it simple, lets compare the Stock Market with a Wet Market (The one that our Moms usually go to buy/sell fresh produce).

When you go to a wet market, products there are group into sections like Meat, Fish, Vegetables, Poultry, etc.

In a market, not all prices are the same. Some are more pricey than others but the cost may increase or decrease depending on the Supply and Demand.

This is the same with The Stock Market. Instead of buying produce, you're buying shares of stocks. When you buy shares of stock, that makes you also a part owner of the company.

Prices of shares increase or decrease depending on the number of buyers and sellers for the Stock.

How you earn through the Stock Market? There are two ways. First is the price appreciation and Second through Dividends. Both of them will be discussed on the next post.

Till then.

That is through the Stock Market.

Now what is the Stock Market Exactly?

The Stock Market is referred to as a place where shares of Public Listed Companies are Traded (Buy or/and Sell).

To make it simple, lets compare the Stock Market with a Wet Market (The one that our Moms usually go to buy/sell fresh produce).

When you go to a wet market, products there are group into sections like Meat, Fish, Vegetables, Poultry, etc.

In a market, not all prices are the same. Some are more pricey than others but the cost may increase or decrease depending on the Supply and Demand.

This is the same with The Stock Market. Instead of buying produce, you're buying shares of stocks. When you buy shares of stock, that makes you also a part owner of the company.

Prices of shares increase or decrease depending on the number of buyers and sellers for the Stock.

How you earn through the Stock Market? There are two ways. First is the price appreciation and Second through Dividends. Both of them will be discussed on the next post.

Till then.

Friday, April 21, 2017

23. Swabeng Dilemma: UITF of MF

Now that I've share a little on both Unit Investment Trust Fund (UITF) and Mutual Funds (MF), which of these two would be better to invest in?

Mutual Funds?

OR

Unit Investment Trust Fund?

While the two may have some similarities, they do have their own differences.

Let us count the ways.

1. Types of funds and investments.

Practically, both offer the same types of funds to their clients. Ranging from Money Market Fund, Bond Fund, Balanced Fund and Equity Fund. There would be some difference in the types of funds that one or the other offer like Dividend Funds, Dollar Funds, Index Funds and the like. Regardless of the list, there is once fund that I'm sure that is tailor-made for you.

For the list of mutual funds, you may check their official website here, while for the list of unit investment trust funds, you may check their official website here.

2. People who handles the funds.

Seasoned professional fund managers are the ones who handles the funds. Speaking of which, they usually handle not just millions of pesos but billions of pesos. Which means they have to trade very meticulously to avoid possible losses.

Imagine the fund manager has 100 Million pesos and Risk of 2 to 3 percent, this means that the fund manager can only lose 2 to 3 million pesos. That's a huge amount for a retail investor like you and me.

The difference is that Mutual Funds are regulated by The Securities and Exchange Commission (SEC) while UITFs are regulated by The Bangko Sentral ng Pilipinas (BSP).

3. Procedures in opening an Account

Each Bank or Mutual Funds have their own specifics when it comes to how to open an account for them and how to top-up your account on a time basis. Just the same their respective sets of procedures will actually help you understand better regarding their type of fund you have chosen.

Definitely, their forms will be different but what needs to be filled-up like your name, address, contact number, email etc are the same across all forms.

4. Funding and Maintaining your account

All funds require a minimum amount to open (from as small as 5000 pesos) and a certain period of time for holding them (from as short as 30 days). Once you were able to fund your account initially, you may add-up accordingly (from as low as 1000 on most accounts) on a timely manner. When you feel that you were able to reach your targets, you may sell it at a profit.

The price of the fund are either expressed in Net Asset Value Per Share or NAVPS for Mutual Funds while for UITF, it is expressed in Net Asset Value per Unit.

5. Fees and Charges.

Also remember that there are corresponding fees on this investment. But there are times that the longer you hold on to your investment, exit fees are usually waived. Annual fees usually is within the 1 to 2 percent of your portfolio as well as there are also sales fee.

While Mutual Funds are Tax-Exempt, UITF's comes with a 20% withholding tax on capital gains. At the same time, management fees are higher for Mutual Funds compared with UITFs.

For now, these are the comparison between a Mutual Fund and a Unit Investment Trust Fund. Let me know in the comment section if there are other similarities or differences between the two.

Mutual Funds?

OR

Unit Investment Trust Fund?

While the two may have some similarities, they do have their own differences.

Let us count the ways.

1. Types of funds and investments.

Practically, both offer the same types of funds to their clients. Ranging from Money Market Fund, Bond Fund, Balanced Fund and Equity Fund. There would be some difference in the types of funds that one or the other offer like Dividend Funds, Dollar Funds, Index Funds and the like. Regardless of the list, there is once fund that I'm sure that is tailor-made for you.

For the list of mutual funds, you may check their official website here, while for the list of unit investment trust funds, you may check their official website here.

2. People who handles the funds.

Seasoned professional fund managers are the ones who handles the funds. Speaking of which, they usually handle not just millions of pesos but billions of pesos. Which means they have to trade very meticulously to avoid possible losses.

Imagine the fund manager has 100 Million pesos and Risk of 2 to 3 percent, this means that the fund manager can only lose 2 to 3 million pesos. That's a huge amount for a retail investor like you and me.

The difference is that Mutual Funds are regulated by The Securities and Exchange Commission (SEC) while UITFs are regulated by The Bangko Sentral ng Pilipinas (BSP).

3. Procedures in opening an Account

Each Bank or Mutual Funds have their own specifics when it comes to how to open an account for them and how to top-up your account on a time basis. Just the same their respective sets of procedures will actually help you understand better regarding their type of fund you have chosen.

Definitely, their forms will be different but what needs to be filled-up like your name, address, contact number, email etc are the same across all forms.

4. Funding and Maintaining your account

All funds require a minimum amount to open (from as small as 5000 pesos) and a certain period of time for holding them (from as short as 30 days). Once you were able to fund your account initially, you may add-up accordingly (from as low as 1000 on most accounts) on a timely manner. When you feel that you were able to reach your targets, you may sell it at a profit.

The price of the fund are either expressed in Net Asset Value Per Share or NAVPS for Mutual Funds while for UITF, it is expressed in Net Asset Value per Unit.

5. Fees and Charges.

Also remember that there are corresponding fees on this investment. But there are times that the longer you hold on to your investment, exit fees are usually waived. Annual fees usually is within the 1 to 2 percent of your portfolio as well as there are also sales fee.

While Mutual Funds are Tax-Exempt, UITF's comes with a 20% withholding tax on capital gains. At the same time, management fees are higher for Mutual Funds compared with UITFs.

For now, these are the comparison between a Mutual Fund and a Unit Investment Trust Fund. Let me know in the comment section if there are other similarities or differences between the two.

Sunday, April 16, 2017

22. Swabeng Strategy: Types of Mutual Funds

I'm sure you have an idea how and where to invest in Mutual Funds according to your risk appetite and time horizon. If not, let me share them with you.

1. Money Market Funds

This type of fund is ideal for those who only intends to invest within a short period of time usually less than 1 year (Between 3 -12 months) and if you need the money with a year or less this fund is for you. This is usually better than keeping it in your savings account. This can be your alternative to your time deposit account since it give a higher interest (subject to risks).

2. Bond Funds

This type of fund is ideal for those who won't be using their money for the next 1 to 3 years. As the name implies,your funds will be mostly invested in Bonds and some cash. This fund is a little bit riskier than Money Market Funds but it still safe investing on this type.

3. Balanced Funds

This type of fund is ideal for those who won't be using their money for the next 3 to 5 years. Balanced funds are invested in a combination of Equities, Bonds, Money Market and keeps a little cash. Risk tolerance for this type is in between the conservative and the aggressive.

4. Equity Funds

This type is for investors who can take as much risk as they can knowing of its possible rewards when the time comes. Most of your funds will be invested in Equities (Mostly Bluechip Stocks or Strong Second-Liners) with a little cash. If you won't be using your money for at least 5 years or more, this type of fund is for you.

Regardless of what you'd choose, what matters more is what works for you.

Till the next post.

1. Money Market Funds

This type of fund is ideal for those who only intends to invest within a short period of time usually less than 1 year (Between 3 -12 months) and if you need the money with a year or less this fund is for you. This is usually better than keeping it in your savings account. This can be your alternative to your time deposit account since it give a higher interest (subject to risks).

2. Bond Funds

This type of fund is ideal for those who won't be using their money for the next 1 to 3 years. As the name implies,your funds will be mostly invested in Bonds and some cash. This fund is a little bit riskier than Money Market Funds but it still safe investing on this type.

3. Balanced Funds

This type of fund is ideal for those who won't be using their money for the next 3 to 5 years. Balanced funds are invested in a combination of Equities, Bonds, Money Market and keeps a little cash. Risk tolerance for this type is in between the conservative and the aggressive.

4. Equity Funds

This type is for investors who can take as much risk as they can knowing of its possible rewards when the time comes. Most of your funds will be invested in Equities (Mostly Bluechip Stocks or Strong Second-Liners) with a little cash. If you won't be using your money for at least 5 years or more, this type of fund is for you.

Regardless of what you'd choose, what matters more is what works for you.

Till the next post.

Tuesday, April 11, 2017

21. Swabeng Discussion: Mutual Funds

Aside from UITFs, there is another type of investment similar to UITF. Do you know what it is?

Its called Mutual Funds.

And what is Mutual Funds anyway?

By definition, A Mutual Fund is a Pool of funds by individuals, companies, corporations and other investors which are invested in different types of instruments. Usually this is handled by a professional fund manager. You and me can invest in a Mutual Fund for as low as a certain amount set by the fund itself.

Like UITFs, Billions of pesos are invested in this type of fund which is carefully studied by the fund manager for capital preservation and to earn more. Like UITFs, there is always a disclaimer that "past Performance doesn't guarantee future results" which simply means there are risks entailed for each type of fund.

You may also visit their official website for more information on Mutual Funds

On the next post, I'll share some of the types of Mutual Funds that you could choose from. I'm sure you already have an idea what are they.

Its called Mutual Funds.

And what is Mutual Funds anyway?

By definition, A Mutual Fund is a Pool of funds by individuals, companies, corporations and other investors which are invested in different types of instruments. Usually this is handled by a professional fund manager. You and me can invest in a Mutual Fund for as low as a certain amount set by the fund itself.

Like UITFs, Billions of pesos are invested in this type of fund which is carefully studied by the fund manager for capital preservation and to earn more. Like UITFs, there is always a disclaimer that "past Performance doesn't guarantee future results" which simply means there are risks entailed for each type of fund.

You may also visit their official website for more information on Mutual Funds

On the next post, I'll share some of the types of Mutual Funds that you could choose from. I'm sure you already have an idea what are they.

Thursday, April 6, 2017

20. Swabeng Strategy: What UITF works best for me?

We know that not all UITFs are created equal. Some are made according to your risk appetite and some are made for how long will you hold the fund.

Regardless of which will you be choosing based on the criteria, what matters is that you understand the risk and reward for each before putting in your hard-earned money to have it work for you.

I will cite some of the most common types of UITF according to your Risk Appetite and Time Horizon.

1. Money Market Fund.

This is a type of UITF that is invested on a short-term basis of usually one year or less. Your funds will be invested in a fixed-income securities . Usually, the return for this type of investment is relatively higher than time deposits and savings account.

This type is recommended if you prefer to preserve your capital and you. don't want to take much risk (for conservative investors) but at the same time you have your money grow within the shortest time possible. Opening a Money Market Fund account can be as low as a thousand pesos depending on the bank you'll be visiting. You could go here to this link for the list banks that offer Money Market Fund (please take note that the data on the link may vary from time to time).

2. Bond Fund

This is a type of UITF that is invested on a short to medium term. This time, your funds will be placed in Bond that you can withdraw after a period of as short as 30 days to as long as a year.

This type is recommended to people who wants to preserve their capital and at the same time doesn't mind the risk (say very low to low risk). You can open a Bond Fund account for as low as five thousand pesos depending on the bank you'll be going to.

3. Balanced Fund

Now this is where the excitement starts. This type is usually invested on a medium term to maximize the growth of your fund. They are usually invested in a combination of fixed-income securities like treasury bills and high yield savings account, bonds and even equities (Stock Market).

This type is recommended to those who won't be using their money for the next 3-5 years so that you would be able to utilize the power of compounding (I'll try to make a post regarding Compounding in the coming weeks).

4. Equity Fund

This would be the type of UITF that is heavily invested (almost 100%) in equities or stocks. Since the fund will be invested heavily on equities, risks for this type of fund are higher than the previous funds (hence this type is considered high-risk). With high-risks, as long as you've planned well, the rewards will be high also. This type of fund is suitable for aggressive, long-term investors who can sit and wait.

If you won't be using your money for the next 5-10 years, this would be the best type of fund for you especially if your goal for this fund is for your retirement or your kid's college education.

Regardless of what type of fund you choose, bottomline is, you have a chance to let your money work for you. You may check this website and you would be able to see the list of Banks that offer a specific type of fund that suits your personality.

Till the next post.

Regardless of which will you be choosing based on the criteria, what matters is that you understand the risk and reward for each before putting in your hard-earned money to have it work for you.

I will cite some of the most common types of UITF according to your Risk Appetite and Time Horizon.

1. Money Market Fund.

This is a type of UITF that is invested on a short-term basis of usually one year or less. Your funds will be invested in a fixed-income securities . Usually, the return for this type of investment is relatively higher than time deposits and savings account.

This type is recommended if you prefer to preserve your capital and you. don't want to take much risk (for conservative investors) but at the same time you have your money grow within the shortest time possible. Opening a Money Market Fund account can be as low as a thousand pesos depending on the bank you'll be visiting. You could go here to this link for the list banks that offer Money Market Fund (please take note that the data on the link may vary from time to time).

2. Bond Fund

This is a type of UITF that is invested on a short to medium term. This time, your funds will be placed in Bond that you can withdraw after a period of as short as 30 days to as long as a year.

This type is recommended to people who wants to preserve their capital and at the same time doesn't mind the risk (say very low to low risk). You can open a Bond Fund account for as low as five thousand pesos depending on the bank you'll be going to.

3. Balanced Fund

Now this is where the excitement starts. This type is usually invested on a medium term to maximize the growth of your fund. They are usually invested in a combination of fixed-income securities like treasury bills and high yield savings account, bonds and even equities (Stock Market).

This type is recommended to those who won't be using their money for the next 3-5 years so that you would be able to utilize the power of compounding (I'll try to make a post regarding Compounding in the coming weeks).

4. Equity Fund

This would be the type of UITF that is heavily invested (almost 100%) in equities or stocks. Since the fund will be invested heavily on equities, risks for this type of fund are higher than the previous funds (hence this type is considered high-risk). With high-risks, as long as you've planned well, the rewards will be high also. This type of fund is suitable for aggressive, long-term investors who can sit and wait.

If you won't be using your money for the next 5-10 years, this would be the best type of fund for you especially if your goal for this fund is for your retirement or your kid's college education.

Regardless of what type of fund you choose, bottomline is, you have a chance to let your money work for you. You may check this website and you would be able to see the list of Banks that offer a specific type of fund that suits your personality.

Till the next post.

Saturday, April 1, 2017

19. Swabeng Discussion: U.I.T.F.

One of the fix for our dilemma on how to grow your money is that you should place them in Unit Investment Trust Fund or what they usually called UITF.

Its like a deposit account but its not. Got my drift?

But what exactly is UITF?

Unit Investment Trust Fund (or UITF) is one form of investment that is available here in the Philippines. It is an open-ended pool of investment that is funded by various investors (you and me). The pooled trust fund is usually denominated in Pesos (the most common) followed by the US Dollar.

In this kind of investment, its the Professional Fund Managers who usually handles the fund. And when we speak of the amount, usually they handle Billions of Pesos which they study the investments thoroughly before investing. And while they are the ones who do the thinking and managing the fund, all you need to do is sit back and relax.

You would notice on various blog posts posting gains from their respective UITF Accounts, please remember the disclaimer that "Past performance doesn't guarantee future results". This means that the gains from your investment for this year is not and will never be the same for next year and for the succeeding years.

The basic requirements in opening a UITF depends on the Bank that you'll be going to (I guess I'll just share it on a different post).

You may also check this Website for more FAQs regarding UITF.

My next question to you is do you know what is the Best UITF Account for you? Stay tuned.

Its like a deposit account but its not. Got my drift?

But what exactly is UITF?

Unit Investment Trust Fund (or UITF) is one form of investment that is available here in the Philippines. It is an open-ended pool of investment that is funded by various investors (you and me). The pooled trust fund is usually denominated in Pesos (the most common) followed by the US Dollar.

In this kind of investment, its the Professional Fund Managers who usually handles the fund. And when we speak of the amount, usually they handle Billions of Pesos which they study the investments thoroughly before investing. And while they are the ones who do the thinking and managing the fund, all you need to do is sit back and relax.

You would notice on various blog posts posting gains from their respective UITF Accounts, please remember the disclaimer that "Past performance doesn't guarantee future results". This means that the gains from your investment for this year is not and will never be the same for next year and for the succeeding years.

The basic requirements in opening a UITF depends on the Bank that you'll be going to (I guess I'll just share it on a different post).

You may also check this Website for more FAQs regarding UITF.

My next question to you is do you know what is the Best UITF Account for you? Stay tuned.

Monday, March 27, 2017

18. Swabeng Discussion: Inflation

Remember the last post about the rising cost of goods and services over time?

We'll try to understand the reason behind it.

Do you also know that this is a Silent Peso-Killer here in the Philippines.

Inflation is basically defined as a general upward price movement of goods and services over a period of time. As time passes, the costs of goods and services increase, making the value of your money decrease over time. There are several factors (will try to add some soon) that determine inflation rate on a monthly and yearly basis.

Inflation is inevitable. No one can escape from it. Take a look at the chart.

Notice that its rising. However, were fortunate that its still a bit low compared with recent years.

Do you have any idea how high it went?

That's more than 50% during the early to mid-80's

Let's say annual inflation is at 3.00% (This is just a safe assumption), you need to make your money work to gain at least 3.00% (to break even) or gain much higher.

I have an example of what would happen to your one-million pesos (deposited one-time) in 15 years given that it's untouched (withholding taxes and other fees are not yet included).

While your money at the bank may still value around one-million, its buying power would significantly reduce over time.

Still not convinced? You may try this and give some variations and I'm sure you'll agree that the end result would still be the same.

Anyway till the next...

We'll try to understand the reason behind it.

Do you also know that this is a Silent Peso-Killer here in the Philippines.

Inflation is basically defined as a general upward price movement of goods and services over a period of time. As time passes, the costs of goods and services increase, making the value of your money decrease over time. There are several factors (will try to add some soon) that determine inflation rate on a monthly and yearly basis.

Inflation is inevitable. No one can escape from it. Take a look at the chart.

Notice that its rising. However, were fortunate that its still a bit low compared with recent years.

Do you have any idea how high it went?

That's more than 50% during the early to mid-80's

Let's say annual inflation is at 3.00% (This is just a safe assumption), you need to make your money work to gain at least 3.00% (to break even) or gain much higher.

I have an example of what would happen to your one-million pesos (deposited one-time) in 15 years given that it's untouched (withholding taxes and other fees are not yet included).

While your money at the bank may still value around one-million, its buying power would significantly reduce over time.

Still not convinced? You may try this and give some variations and I'm sure you'll agree that the end result would still be the same.

Anyway till the next...

Wednesday, March 22, 2017

17. Swabeng Dilemma: The Power of Your Money (An Introduction to Inflation)

Have you noticed that when you were young, the cost of a certain product or service would only be this amount only to find out years later, the price will increase through the years?

I remember a couple of years back (circa mid-90's), a Burger McDo Meal back then costs only 39 pesos (which includes regular fries and drinks). Fast forward to today, now it costs double at 79 pesos (with the same inclusions).

Within the span of almost two decades, the price of the Burger McDo Meal has doubled given that the product is still the same.

Also, what I remember was when we use to do grocery a couple of years back (circa mid-90's again), You would be able to buy a cart full of groceries for around 2000 pesos. Fast Forward to today again, the same 2000 pesos won't even fill half of the cart (unless your willing to spend more than 2000 pesos).

Given the same span of years, the value of money decreased overtime and you'd notice by then prices of good increase on a time-basis (annually).

I would also remember whenever my Dad takes me to school before he goes to work, Prices of fuel (particularly Diesel) costs around 7.xx pesos per liter. His budget of 500 pesos for diesel would give him around 71.5 Liters that usually lasts a couple of days (given his route would be home-school-work-home).

However, how far can today's 500 pesos worth of diesel can take you? How long it could last given the same route my dad takes? Definitely a few days less that what it can cover a couple years back.

And even way back, I remember my parents telling me that they only receive this amount of money as allowance. Lets say a couple of cents back during their time. They would told me that a bottle of softdrink costs between 5 to 10 centavos and a whole fried chicken at Max's back costs 5 pesos (compared to 449 pesos today).

Imagine the increase from 5 pesos to 449 pesos would be a staggering 8880%. Yes that's 8880% and I kid you not.

Anyway, why costs of goods back then costs much lower than it is today.

I remember a couple of years back (circa mid-90's), a Burger McDo Meal back then costs only 39 pesos (which includes regular fries and drinks). Fast forward to today, now it costs double at 79 pesos (with the same inclusions).

Within the span of almost two decades, the price of the Burger McDo Meal has doubled given that the product is still the same.

Also, what I remember was when we use to do grocery a couple of years back (circa mid-90's again), You would be able to buy a cart full of groceries for around 2000 pesos. Fast Forward to today again, the same 2000 pesos won't even fill half of the cart (unless your willing to spend more than 2000 pesos).

Given the same span of years, the value of money decreased overtime and you'd notice by then prices of good increase on a time-basis (annually).

I would also remember whenever my Dad takes me to school before he goes to work, Prices of fuel (particularly Diesel) costs around 7.xx pesos per liter. His budget of 500 pesos for diesel would give him around 71.5 Liters that usually lasts a couple of days (given his route would be home-school-work-home).

However, how far can today's 500 pesos worth of diesel can take you? How long it could last given the same route my dad takes? Definitely a few days less that what it can cover a couple years back.

And even way back, I remember my parents telling me that they only receive this amount of money as allowance. Lets say a couple of cents back during their time. They would told me that a bottle of softdrink costs between 5 to 10 centavos and a whole fried chicken at Max's back costs 5 pesos (compared to 449 pesos today).

Imagine the increase from 5 pesos to 449 pesos would be a staggering 8880%. Yes that's 8880% and I kid you not.

Anyway, why costs of goods back then costs much lower than it is today.

Friday, March 17, 2017

16. Swabeng Dilemma: Beyond your Savings Accounts

Let's say that you were able to pay your debts, completed your emergency fund and learned some basics on Savings Accounts. What's next for you?

Would you just spend the incoming money thinking that your already settled and financially secured for the years to come?

Or would you thirst for more and try to learn as much financial knowledge as possible?

I'm sure you have did your part more than I do as of this time and I know somehow your Financial IQ has increased from zero to something that you could pass on to future generations.

As for me, I'm still thinking what to write next. Care to comment so you could give me an idea on what to share?

Sunday, March 12, 2017

15. Swabeng Thoughts: And the Best Bank is.....

Sorry it took me a while to gather some of the latest data regarding the banks where you can park your money for emergency use.

Here are some list of the known banks (unranked) here in the country. I'll just list down their basic services (Savings Account). You can also visit their respective websites for any updates.

1. BDO

2. Security Bank

3. BPI

4. Metrobank

Anyway, I'll try to update this from time to time. Just hit me a comment which bank would you want me to add (but limited to Savings Account for now)

Here are some list of the known banks (unranked) here in the country. I'll just list down their basic services (Savings Account). You can also visit their respective websites for any updates.

1. BDO

2. Security Bank

3. BPI

4. Metrobank

Anyway, I'll try to update this from time to time. Just hit me a comment which bank would you want me to add (but limited to Savings Account for now)

Tuesday, March 7, 2017

14. Swabeng Dilemma: Your Money in Banks

Banks are establishments that keep safe your money while it earns interest (depending on what type of account you'll open with them). You can also lend money from them and pay them back at an interest. Sounds interesting right?

When I was young, my Parents taught me how to save money on banks. I think, I was 10 or 11 years old when I first open my first savings account. I was really excited that time my dad opened an account for me. The texture of the passbook makes me want to save money back then.

My wife is also an advocate of banks. Whenever she can, she usually puts her money in banks where she can easily withdraw anytime of the day.

Over the years, I noticed that the longer my money is in the bank, the less chance it earns for me. Did you notice it too? I'm sure you do!

Please, share your thoughts on the comment section on Banking and how it has affect your financial life.

When I was young, my Parents taught me how to save money on banks. I think, I was 10 or 11 years old when I first open my first savings account. I was really excited that time my dad opened an account for me. The texture of the passbook makes me want to save money back then.

My wife is also an advocate of banks. Whenever she can, she usually puts her money in banks where she can easily withdraw anytime of the day.

Over the years, I noticed that the longer my money is in the bank, the less chance it earns for me. Did you notice it too? I'm sure you do!

Please, share your thoughts on the comment section on Banking and how it has affect your financial life.

Thursday, March 2, 2017

13. Swabeng Dilemma: What Insurace Suits you Best?

In my last post, I shared to you my perception of having an insurance back then when I was young.

On this post, while I'm sure you had a better understanding on the importance of having an Insurance, you might get overwhelmed with the options available today. Even when I was about to pick what type of insurance I'll be getting, seeing new types got me more and more confused.

Anyway, here are the most common types of Insurance that are available in the Philippine Market.

Just remember that I won't be specifying any provider here and I will not go technical here so as not to overload you with information (those stuff would be reserved for later as I need to do a lot of readings too)

1. Traditional Life Insurance

Also known as ordinary life or straight life, this is a type of insurance that provides coverage for your entire life. This kind of policy is sometimes described as plain vanilla insurance.

These includes Term Life Insurance, Whole Life Insurance, Endowment Life Insurance among the most common in the Philippines.

2. Non-Traditional Life Insurance

This is usually linked with investments. For instance, unit linked insurance plans allows the insured to choose between equity, debt and mixed market investment vehicles.

Depending on the risks involved, the insurance plans will differ for every customer. The premiums for these plans also differ. You should be aware of this information before investing in these plans.

I told you, I'll just share the most common types of Insurance here in the Philippines. While there are a lot more to choose from, that would be all for now.

See you soon. And please do comment if you wish to add something or share something.

On this post, while I'm sure you had a better understanding on the importance of having an Insurance, you might get overwhelmed with the options available today. Even when I was about to pick what type of insurance I'll be getting, seeing new types got me more and more confused.

Anyway, here are the most common types of Insurance that are available in the Philippine Market.

Just remember that I won't be specifying any provider here and I will not go technical here so as not to overload you with information (those stuff would be reserved for later as I need to do a lot of readings too)

1. Traditional Life Insurance

Also known as ordinary life or straight life, this is a type of insurance that provides coverage for your entire life. This kind of policy is sometimes described as plain vanilla insurance.

These includes Term Life Insurance, Whole Life Insurance, Endowment Life Insurance among the most common in the Philippines.

2. Non-Traditional Life Insurance

This is usually linked with investments. For instance, unit linked insurance plans allows the insured to choose between equity, debt and mixed market investment vehicles.

Depending on the risks involved, the insurance plans will differ for every customer. The premiums for these plans also differ. You should be aware of this information before investing in these plans.

I told you, I'll just share the most common types of Insurance here in the Philippines. While there are a lot more to choose from, that would be all for now.

See you soon. And please do comment if you wish to add something or share something.

Saturday, February 25, 2017

12. Swabeng Dilemma: To be or NOT To be Insured

When I was young (around 20's), I have a different perception when it comes to Insurance. To me (back then), insurance is a bit complicated that my thinking was you need to have a lawyer to get insured (sounds weird right).

Also, my belief before that insurance was for the rich and wealthy people. Why pay premiums when you can use your money on the things that you may need right? Am I also alone on this?

There are also thousands (if not millions) who are also working yet uninsured. If my hunch is correct, most of the working class think that their SSS (or GSIS for Government Employees) would be enough for them. They would also think that Insurance issued by their respective companies (via tie-ups). This in fact would be one of the reasons why Filipinos don't have an insurance to protect themselves.

Here are some interesting reasons why most still doesn't have any insurance. Technical aspects not yet included.

1. The Habit of Ignorance.

Majority of the working class would rather not discuss about it as they would thing it is always been related to dying. They would just shrug it off and probably say they don't need it yet since they are still young and healthy.

Let's face it, they will most likely be contented on SSS (or GSIS for Government Employees) as far as they're thinking. Another factor is the list of definitions insurance term that seem to complicate them leading to simply ignoring it altogether.

2. Impressions of the Past.

Probably for some reason, they may have been misinformed by past insurance agents, and probably misleading them at some point. These are people who may have been scammed in the past with their former insurance agent.

Trauma from past experiences prevent some people from accepting the fact that they need insurance to protect their future as well as their loved ones.

3. The lack of funds.

Now this would be the most common reason (This was also my reason back in the past) why most people is not into having themselves insured. They would probably use the money on something they can be of use today than tomorrow. While there is nothing wrong with saving and investing, have you ever thought what happens when you are unable to save and invest?

As time passes by and I was getting a bit older (and more wiser), it is very important for us to get insured. I feel that this would be the best time (actually 2nd best time) to have ourselves insured.

But the next question would be, What kind of Insurance will work for me.

That would be on my next post.

Also, my belief before that insurance was for the rich and wealthy people. Why pay premiums when you can use your money on the things that you may need right? Am I also alone on this?

I'm not alone!

There are also thousands (if not millions) who are also working yet uninsured. If my hunch is correct, most of the working class think that their SSS (or GSIS for Government Employees) would be enough for them. They would also think that Insurance issued by their respective companies (via tie-ups). This in fact would be one of the reasons why Filipinos don't have an insurance to protect themselves.

Here are some interesting reasons why most still doesn't have any insurance. Technical aspects not yet included.

1. The Habit of Ignorance.

Majority of the working class would rather not discuss about it as they would thing it is always been related to dying. They would just shrug it off and probably say they don't need it yet since they are still young and healthy.

Let's face it, they will most likely be contented on SSS (or GSIS for Government Employees) as far as they're thinking. Another factor is the list of definitions insurance term that seem to complicate them leading to simply ignoring it altogether.

2. Impressions of the Past.

Probably for some reason, they may have been misinformed by past insurance agents, and probably misleading them at some point. These are people who may have been scammed in the past with their former insurance agent.

Trauma from past experiences prevent some people from accepting the fact that they need insurance to protect their future as well as their loved ones.

3. The lack of funds.

Now this would be the most common reason (This was also my reason back in the past) why most people is not into having themselves insured. They would probably use the money on something they can be of use today than tomorrow. While there is nothing wrong with saving and investing, have you ever thought what happens when you are unable to save and invest?

As time passes by and I was getting a bit older (and more wiser), it is very important for us to get insured. I feel that this would be the best time (actually 2nd best time) to have ourselves insured.

But the next question would be, What kind of Insurance will work for me.

That would be on my next post.

Monday, February 20, 2017

11. Swabeng Strategy: Building up the Foundation of your Emergency Fund

When all of debts have been settled, the next phase is to build-up your emergency fund to ensure that you don't need to be in debt again in case an emergency happens.

By definition, An emergency fund is an account used to set aside funds needed in the event of a personal financial dilemma, such as the loss of a job, a debilitating illness or a major expense.

So this only means that it should be a MUST for every working citizen (breadwinner or supporter). Anyway, here are some basic steps on building your emergency fund.

1. Determine your monthly budget at its most basic.

You need to calculate the total amount of your basic expenses. This includes utility bills (the most basic would be electricity and water), food for the table (excluding eat-outs at the malls and/or restaurants), your kids' basic expenses (schooling). Sale at the Malls are NOT included in your emergency fund.

2. Determine the amount you need to build your emergency fund.

Once you determine your basic monthly cost (sale is not included), you need to know how much would you need (for how long). Most local (and foreign) blogs would advise to have at least 3 months of your basic expenses. Some would say at least 6 months worth of your basic expenses. But for me, I'd go the distance and recommend 9 to 12 months worth of your basic expenses. Sounds insane right? But for me, I'd rather be safe than sorry,

3. Determine if you need a buffer for your emergency fund.

While you were able to determine your basic budget for each month, You also need to consider the possibilities of encountering any unnecessary incidents. These incidents may affect your budget once it happens. A few examples would be expenses if your car broke down or if someone in your family got sick and hospitalized. If you decide to save 9 to 12 months worth of your basic expenses, a 10-20% buffer will do. If your saving for 6 months, a 20-30% buffer will do. And if your saving for only 3 months, a 50% buffer should do. The bigger your emergency fund, the smaller the buffer. Let me know in the comment section if you have other ideas on building your emergency fund buffer.

4. Determine the amount of time that you need to build your emergency fund.

Building an emergency fund takes time. It may take a year to a couple of years depending on your strategy. Patience is the key factor here because the bigger your targeted emergency fund, the longer it may take for you to accomplish it. The good thing is you don't need to be in a hurry saving up for it especially if you are still able and working. As I posted this, I'm still working on my emergency fund. =)

5. Determine the possible source of your emergency fund.

Now that you know your basic monthly budget and how much would you need for a certain period of time, you need to know where would you fund your emergency fund until it hits your target goal. The first thing that may come to your mind is to fund it from your paycheck. You may allot 5-20% depending on your objectives and targets. If you want to speed-up your funding, try to freelance your work or do sell something that people need. That way you'd be able to reach your target at the soonest time possible.

I hope I was able to give you some basic guidelines on building your emergency fund. But were not yet on the technical aspect of it (this will be on another post). If you have other ideas on building-up your emergency fund, please feel free to comment below. =)

By definition, An emergency fund is an account used to set aside funds needed in the event of a personal financial dilemma, such as the loss of a job, a debilitating illness or a major expense.

So this only means that it should be a MUST for every working citizen (breadwinner or supporter). Anyway, here are some basic steps on building your emergency fund.

1. Determine your monthly budget at its most basic.

You need to calculate the total amount of your basic expenses. This includes utility bills (the most basic would be electricity and water), food for the table (excluding eat-outs at the malls and/or restaurants), your kids' basic expenses (schooling). Sale at the Malls are NOT included in your emergency fund.

2. Determine the amount you need to build your emergency fund.

Once you determine your basic monthly cost (sale is not included), you need to know how much would you need (for how long). Most local (and foreign) blogs would advise to have at least 3 months of your basic expenses. Some would say at least 6 months worth of your basic expenses. But for me, I'd go the distance and recommend 9 to 12 months worth of your basic expenses. Sounds insane right? But for me, I'd rather be safe than sorry,

3. Determine if you need a buffer for your emergency fund.

While you were able to determine your basic budget for each month, You also need to consider the possibilities of encountering any unnecessary incidents. These incidents may affect your budget once it happens. A few examples would be expenses if your car broke down or if someone in your family got sick and hospitalized. If you decide to save 9 to 12 months worth of your basic expenses, a 10-20% buffer will do. If your saving for 6 months, a 20-30% buffer will do. And if your saving for only 3 months, a 50% buffer should do. The bigger your emergency fund, the smaller the buffer. Let me know in the comment section if you have other ideas on building your emergency fund buffer.

4. Determine the amount of time that you need to build your emergency fund.

Building an emergency fund takes time. It may take a year to a couple of years depending on your strategy. Patience is the key factor here because the bigger your targeted emergency fund, the longer it may take for you to accomplish it. The good thing is you don't need to be in a hurry saving up for it especially if you are still able and working. As I posted this, I'm still working on my emergency fund. =)

5. Determine the possible source of your emergency fund.

Now that you know your basic monthly budget and how much would you need for a certain period of time, you need to know where would you fund your emergency fund until it hits your target goal. The first thing that may come to your mind is to fund it from your paycheck. You may allot 5-20% depending on your objectives and targets. If you want to speed-up your funding, try to freelance your work or do sell something that people need. That way you'd be able to reach your target at the soonest time possible.

I hope I was able to give you some basic guidelines on building your emergency fund. But were not yet on the technical aspect of it (this will be on another post). If you have other ideas on building-up your emergency fund, please feel free to comment below. =)

Friday, February 17, 2017

10A. Swabeng Thoughts: Message from COL Financial

I'd probably break (just once in a while) this habit of posting once every 5 days as I just receive a message from COL Founder and Chairman Mr Edward Lee today.

It was a very insightful letter as he reminds us the value of not just investing in the Stock Market, but also investing in yourself to be Financially Educated.

Here is the letter that he sent me (and probably thousands of COL Financial Clients). I hope you'd be able to learn from his letter.

Dear COL Financial Client,

One of our biggest concerns at COL Financial is that many people start investing or trading in the stock market, even though they don't understand how to do it. Worse, some people even invest in speculative issues with no understanding of fundamentals, turning investing into gambling as they get excited at the prospect of making a high return.

This is the reason why people lose money in the stock market, and it's also the reason why people lose faith in the stock market.

People enjoy the rush of earning money from something they don't understand how to do, not knowing that the boring, slowly-but-surely way of investing is what works out in the long term.

It's why we are always encouraging everyone, not just COL Clients, to attend and learn from our investing seminars. We want you to understand the rules of investing and trading, so you don't end up wasting your hard-earned money.

Aside from arming yourself with investing knowledge, I also encourage you to manage your risk.

Start by deciding how much money you are comfortable placing in the stock market. Then, rebalance your portfolio regularly, at least twice or thrice a year, so that the amount of money you have in the stock market is always an amount you're comfortable with.

Finally, I would like to remind you that what matters is how long you're in the market----- not timing the market. While we're not certain what will exactly happen in the stock market this 2017, know that the long-term growth story of our country is strong and intact.

Thus, regularly investing in the Philippine stock market will bring good returns in the long term. It may not be as exciting as following a hot stock tip, but as George Soros says, good investing is boring.

One of our biggest concerns at COL Financial is that many people start investing or trading in the stock market, even though they don't understand how to do it. Worse, some people even invest in speculative issues with no understanding of fundamentals, turning investing into gambling as they get excited at the prospect of making a high return.

This is the reason why people lose money in the stock market, and it's also the reason why people lose faith in the stock market.

People enjoy the rush of earning money from something they don't understand how to do, not knowing that the boring, slowly-but-surely way of investing is what works out in the long term.

It's why we are always encouraging everyone, not just COL Clients, to attend and learn from our investing seminars. We want you to understand the rules of investing and trading, so you don't end up wasting your hard-earned money.

Aside from arming yourself with investing knowledge, I also encourage you to manage your risk.

Start by deciding how much money you are comfortable placing in the stock market. Then, rebalance your portfolio regularly, at least twice or thrice a year, so that the amount of money you have in the stock market is always an amount you're comfortable with.

Finally, I would like to remind you that what matters is how long you're in the market----- not timing the market. While we're not certain what will exactly happen in the stock market this 2017, know that the long-term growth story of our country is strong and intact.

Thus, regularly investing in the Philippine stock market will bring good returns in the long term. It may not be as exciting as following a hot stock tip, but as George Soros says, good investing is boring.

Sincerely,

Edward K. Lee

Founder & Chairman of COL Financial

Please note that I'll be sharing some of my knowledge about the Stock Market in the coming months as I just need to follow my outline in posting.

Edward K. Lee

Founder & Chairman of COL Financial

Please note that I'll be sharing some of my knowledge about the Stock Market in the coming months as I just need to follow my outline in posting.

Wednesday, February 15, 2017

10. Swabeng Dilemma: Do I Really Need Emergency Funds?

Let's say you were able to clear out all your debt within the time frame that you've set. Congratulations!

Then what's next? Would you borrow again to get new debt and pay them again?

At this point, do you really want you financial status to be that way? Get Debt, Pay Debt over and over until your done?

I hope you'd realize that if you never get out of that Debt Cycle, your future generation will be the ones to suffer in the long run. Which means that in case something happens to you while you're still on Debt, Who will take your place to settle them? It would have been easier that your entire debt will be wiped out once you're done but that's not the case here.

Do I Really Need Emergency Funds? First timers would answer NO for the following reasons

1. I have all the time in the world.

Being young (say you just finished college and just started your first job) would be the first excuse of not saving up for emergencies. I'm sure most (me included years ago) of you are still dependent on our parents as we still live with them and they still cover rent (or mortgage), food and all the basic utilities (water, electricity, cable, etc). In the event that something unfortunate *knocks on wood* happens to either one of them (or both) do you know what happens next?

2. I don't earn that much yet for me to save some.

Personally, this was my excuse when I was starting. I kept on saying I'll start building my emergency fund when I'm earning a heftier salary. I realized that If I can't save money early in my career, I would have a hard time during the same right now.

3. I'll just worry about money when there is an emergency.

While you have your parents, relatives, friends, and even your credit card, never assume that they're always be there to take care of you in case of emergencies. You should realize that they have their own financial obligations to take care of. Also do not consider your credit cards as your emergency funds, remember that if you pay the minimum and/or on a delayed basis, its interest will pile-up until your debt doubles. Would you want that?

On my next post, I'll show you how to build your emergency fund so you'll have a peaceful sleep every night.

Then what's next? Would you borrow again to get new debt and pay them again?

At this point, do you really want you financial status to be that way? Get Debt, Pay Debt over and over until your done?

I hope you'd realize that if you never get out of that Debt Cycle, your future generation will be the ones to suffer in the long run. Which means that in case something happens to you while you're still on Debt, Who will take your place to settle them? It would have been easier that your entire debt will be wiped out once you're done but that's not the case here.

Do I Really Need Emergency Funds? First timers would answer NO for the following reasons

1. I have all the time in the world.

Being young (say you just finished college and just started your first job) would be the first excuse of not saving up for emergencies. I'm sure most (me included years ago) of you are still dependent on our parents as we still live with them and they still cover rent (or mortgage), food and all the basic utilities (water, electricity, cable, etc). In the event that something unfortunate *knocks on wood* happens to either one of them (or both) do you know what happens next?

2. I don't earn that much yet for me to save some.

Personally, this was my excuse when I was starting. I kept on saying I'll start building my emergency fund when I'm earning a heftier salary. I realized that If I can't save money early in my career, I would have a hard time during the same right now.

3. I'll just worry about money when there is an emergency.

While you have your parents, relatives, friends, and even your credit card, never assume that they're always be there to take care of you in case of emergencies. You should realize that they have their own financial obligations to take care of. Also do not consider your credit cards as your emergency funds, remember that if you pay the minimum and/or on a delayed basis, its interest will pile-up until your debt doubles. Would you want that?

On my next post, I'll show you how to build your emergency fund so you'll have a peaceful sleep every night.

Friday, February 10, 2017

9. Swabeng Thoughts: How young you should really start investing

There is a saying saying that "The Best Time to Invest was Yesterday. The Second Best Time to Invest is Now. And the Worst Time to Invest is Tomorrow"

These were the words I live by when I started my journey towards Financial Success.

I remember when I started working, the only way I knew back how to make my money grow back then is by depositing it in banks. That was during the turn of the century, or should I say the turn of the millennium.

I remember being invited in talks on business only to realize that its more on MLM or what we call Multi-Level Marketing rather than promoting the business itself. It was kinda disappointing after hearing every talk which made me lose more interest during that time. I was in my late teens back then.

I didn't realize time flies so fast and I'll be 40 years old after a few more years. That was close to 15-20 wasted years (well almost) that I should have even attempted to learn Financial Literacy at least once during the turn of the century.

Anyway, if you're still single and just started working, I suggest you start investing NOW. How much you invest shouldn't be an issue to you. While starting, you should also invest in yourself by having yourself insured, getting fit and healthy and try to learn as much as you can. Investing as early as NOW (plus if your in your 20's), it would give you a lot of years to go to maximize your gains.

And if you're already in your 30's and above, start NOW!

These were the words I live by when I started my journey towards Financial Success.

I remember when I started working, the only way I knew back how to make my money grow back then is by depositing it in banks. That was during the turn of the century, or should I say the turn of the millennium.

I remember being invited in talks on business only to realize that its more on MLM or what we call Multi-Level Marketing rather than promoting the business itself. It was kinda disappointing after hearing every talk which made me lose more interest during that time. I was in my late teens back then.

I didn't realize time flies so fast and I'll be 40 years old after a few more years. That was close to 15-20 wasted years (well almost) that I should have even attempted to learn Financial Literacy at least once during the turn of the century.

Anyway, if you're still single and just started working, I suggest you start investing NOW. How much you invest shouldn't be an issue to you. While starting, you should also invest in yourself by having yourself insured, getting fit and healthy and try to learn as much as you can. Investing as early as NOW (plus if your in your 20's), it would give you a lot of years to go to maximize your gains.

And if you're already in your 30's and above, start NOW!

Sunday, February 5, 2017

8. Swabeng Dilemma: Does age matters?

In Love and Romance, people say age does not matter as long as they love each other. Isn't that sweet?

However, that is not the case when it comes to Financial Planning.

I'm not saying that if you're old, don't plan. What I mean is, time may not be on our side anymore especially if we keep on contemplating and procrastinating when is the time to start.

Wise men say the best time to start your financial freedom was yesterday. The second best time would be today. And the worst time would be tomorrow.

Let me share you an example some of the popular excuses why most people hold of starting their way to Financial Freedom and their corresponding ages

Most millennials have the mantra of YOLO (You Only Live Once). Nothing bad with it. But if you neglect its greatest advantage (TIME), you may never be able to fully maximize your gains in the long run.

Well most newly-wed couple would say building a home and having kids are their top most priorities. Again, there is nothing wrong with it as long as you know how to prioritize and be able to save and invest whenever possible.

40's: My kids are already studying. I'd probably start saving when my kids are finished schooling.

This is where it starts to really get difficult. Your kids are growing which means they would need more of your financial assiatance.

You may be probably in your 60's by the time your kids are done with college. I'm sure this is the age group where financial responsibility is at its heaviest. You may also begin to feel weak and tired more often than when you were in your 20's or 30's.