My apologies for just showing a few on the last post. :D

Anyway, Here are the two ways how to earn in the Stock Market. This will be the first part.

1. Price Appreciation.

A. Let's say on January 4, 2010, you bought 1000 shares of Jollibee (Code: JFC) priced at 59.00 pesos per share (closing price) which means you have spent around 59,000 pesos (exclusive of fees and charges).

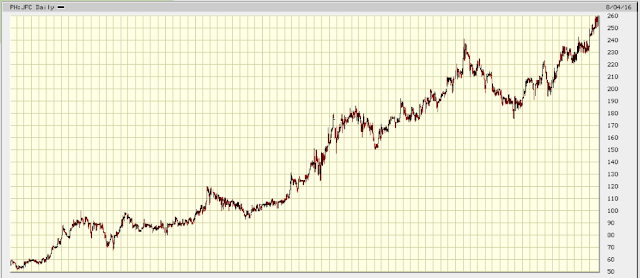

Then on August 4, 2016, you decide to sell all of your 1000 shares of Jollibee for 260.00 pesos per share (closing price). This means your 59,000 pesos has grown to 260,000 (exclusive of fees and charges) or your money has grown to around 340% since the time you bought shares of JFC. You may refer to the chart below for the price movement of JFC from the time the shares have been bought to the time the shares have been sold.

Jollibee's Uptrend

B. On the other hand, on September 4, 2014, you bought 100 shares of PLDT (Code: TEL) priced at 3460 pesos per share (closing price) which means you have spent around 346,000 pesos (exclusive of fees and charges).

Then on December 5, 2016, there was an emergency that you needed a certain amount of money but your only source was the stocks of TEL that you have. You have no other choice but to sell all 100 shares of TEL for 1280 pesos per share (exclusive of fees and charges). From the time you bought TEL until you sold them, your loss was at 63%, some that all of us don't want to happen (sell at a loss). You may refer to the chart below for the price movement of TEL from the time the shares have been bought to the time the shares have been sold.

PLDT's Downtrend

Then how did the price per share of JFC went up from 55 pesos to 260 pesos? and How did the price per share of TEL went down from 3460 pesos to 1280 pesos?

Here's the explanation.

Price of a Stock is usually dictated by the buyers and the sellers. In a wet market it is usually called the law of supply and demand. If there is a high demand for a stock, its price would usually go up. On the other hand, if the demand for the stock is low, its price would usually go down.

Other factors for the increase and decrease of the stock's price includes updates (positive/negative) from the business, market sentiment, annual (or quarter) earnings report, as well as local and global issues that may have something to do where the certain stock is categorized.

On the next post, we will show you the other way on how to earn money in the Stock Market. Stay tuned.